The Financial Aspects of Collecting Oil Paintings

The Enduring Appeal of Oil Paintings as Investment Assets

The Enduring Appeal of Oil Paintings as Investment Assets

Why Oil Paintings are Investment-Worthy

With unparalleled color vibrancy and durability, oil paintings have long attracted collectors. Scarce works by desired artists can also gain tremendous financial value over time. Understanding the oil painting market helps collectors make informed decisions between aesthetic appeal and investment potential.

Financial Value of Oil Paintings Over Time

While Old Masters drew the attention of early collectors, late 19th-century Impressionist works eventually set records after initially being panned. Postwar 20th-century art saw Abstract Expressionists like Pollock gain recognition. Contemporary stars like Gerhard Richter and Cecily Brown keep pushing boundaries and prices for living artists. Auction prices for oil paintings ebb and flow across eras.

Famous Oil Paintings and Their Auction Prices

Renowned oil paintings have soared to astronomical prices at auctions, epitomizing artistic mastery and cultural significance. Take van Gogh's "Portrait of Dr. Gachet," an emblem of post-impressionism, fetched a staggering $82.5 million in 1990. Equally striking is Picasso's "Les Femmes d'Alger," a vibrant exploration of form and color that commanded an astonishing $179.4 million in 2015. These market leaders not only embody artistic brilliance but also reflect the investment value attached to iconic artworks, shaping the narrative of art's worth. Their auction prices serve as a testament to the enduring allure and enduring financial clout of masterpieces in the art world.

Factors Affecting Oil Painting Prices

If more people want a scarce painting, values rise. An artist’s notoriety and productivity affect available works. Subjects like portraits or still lifes vary in appeal. Provenance listing prior owners also enhances allure. Condition is paramount, with masterpiece quality work fetching exponentially more. Global economic shifts likewise sway prices internationally.

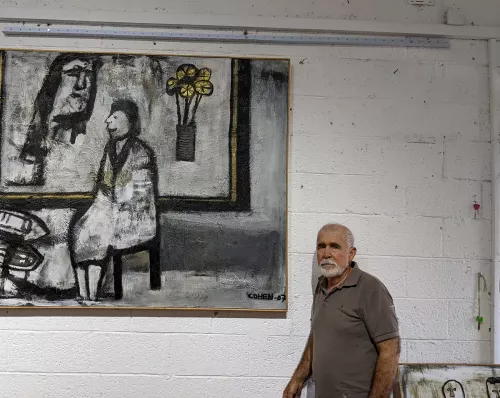

Understanding the Importance of Authenticity and Ownership History

Confirming identity and ownership lineage prevents forgeries from infiltrating collections while verifying scholarly value, aiding both authentication and collecting. Gaps in records can compromise credibility. Solid provenance signals wise past stewards bolstering significance. Exhibition and literature citations also support masterwork status. Thorough provenance protects investments.

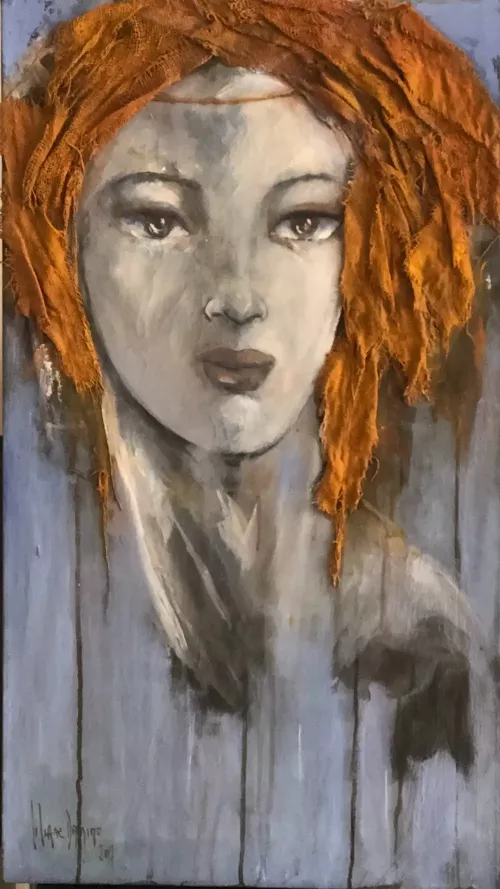

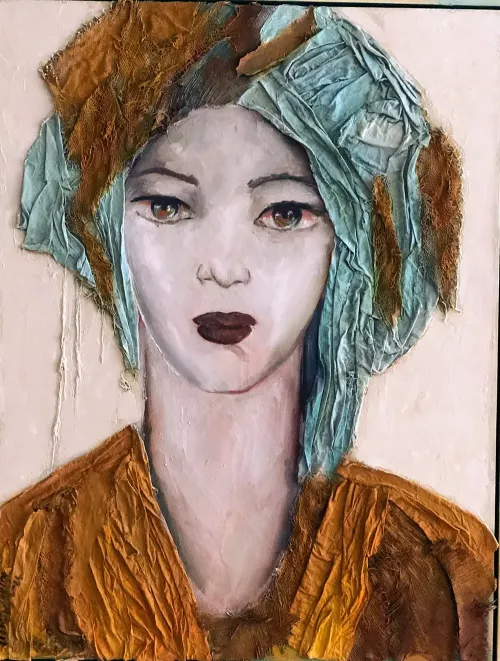

Identifying Investment Opportunities in Contemporary Oil Paintings

Watching promising emerging and mid-career artists allows savvy collectors to purchase early as markets gather momentum. Noting gallery representation, museum acquisitions, and major competition wins indicates growing critical endorsement. Bidding levels at auction provide pricing guidance. Though riskier than established giants, identifying rising stars brings investment upside before widespread fame is fully priced in.

Tips for New Collectors

Aspiring collectors benefit from a thorough research, verifying authenticity and provenance. Understand diverse genres, artists, and market trends. Start with smaller investments, gradually exploring personal taste. Engage with reputable galleries or auction houses and consider seeking expert guidance to ensure informed purchases.

When and How to Cash in on Your Investment

Timing is crucial; monitor market shifts and artist relevance. Consider auctions during peak seasons and evaluate demand trends. Choose selling platforms wisely, from traditional auctions to online platforms, aligning with the artwork's value and audience. Seek advice from art consultants or agents for optimal selling strategies.

Balancing Financial and Aesthetic Value in Your Art Collection

Ultimately, artworks held long-term perform best when also bringing visual intrigue that sustains interest beyond monetary potential. Oil painting investments stand sturdier when backed by artistic meaning beyond profit motives. Yet for interested newcomers, armed with awareness of market movements and authentication best practices, exciting returns become possible especially when passion aligns with prescient picks.